Navigating the vast/uncharted territories/complex world of the stock market can feel daunting, especially for newcomers/beginners/fresh faces. However, opening a Demat account acts as your stepping stone/entry point/initial hurdle into this exciting financial landscape. A Demat account, short for "Dematerialized Account," allows you to purchase/acquire/invest in shares of companies electronically, eliminating/removing/dispensing with the need for physical share certificates. Think of it as your digital portfolio/online investment hub/virtual stock chest, securely holding your investments and providing easy access to trade whenever/as needed/at your discretion.

- Gaining/Unlocking/Accessing a Demat account opens doors to a world of opportunities, empowering/enabling/allowing you to participate/engage/join in the stock market and potentially grow your wealth.

- It streamlines the trading process/investment journey/financial workflow, making it efficient/seamless/effortless for you to buy, sell, and manage your investments.

Furthermore/Additionally/Moreover, a Demat account provides crucial features like real-time market data, portfolio tracking/investment monitoring/performance analysis, and secure transaction history, making it an invaluable tool/resource/asset for any serious investor.

Achieving Financial Freedom: How to Open a Demat Account

Embarking on the journey to financial independence is a goal many aspire to. A crucial step in this endeavor is opening a Demat account, which allows you to participate in the dynamic world of securities. This virtual platform acts as your gateway to owning shares, bonds, and other financial instruments. Opening a Demat account is a straightforward process that can be completed online with most brokers.

To begin, you'll need to submit an application How to Open Demat Account? form electronically, supplying your personal and financial details. Once your application is evaluated, the broker will authenticate your identity and initiate your Demat account. You'll then receive a unique Demat ID, which you'll use to access and manage your securities.

- Advantages of Opening a Demat Account:

- Efficiently Hold Your Securities

- Enhance Trading Transactions

- Access a Wider Range of Investments

Dive into Demat Account Opening in Simple Steps

Want to jumpstart your investment journey? Opening a Demat account is the crucial first step. But don't stress, it's easier than you think.

Here's your step-by-step guide to mastering the process:

- First and foremost, select a reputable Demat provider. Research different options and compare their costs.

- Then, assemble the necessary information, such as proof of identity, address, and PAN card.

- Submit the Demat account request online or physically.

- Provide your information to the provider.

- Once verification, your Demat account will be activated. You can now begin trading!

With these simple steps, you'll be ready to go in no time.

A Guide to Demat Accounts

A demat account is a must-have for investors who want to participate in the capital markets. It serves as a digital repository for your securities, eliminating the need for physical share certificates.

Here are some essential things to know about demat accounts:

- Setting up a demat account is a easy process that can be facilitated digitally.

- You'll need to provide some personal information, such as your identity, residence, and tax identification number.

- Opting for a reputable financial institution is crucial. The DP will hold your securities in your demat account safely.

Once your account is operational, you can purchase and dispose securities digitally. It's a convenient way to manage your investments.

Gain Your Investment Journey: A Step-by-Step Demat Account Opening Process

Embarking on the path of investment can be both exciting and daunting. First step toward building your financial future, it's crucial to create a Demat account. This virtual repository securely safeguards your online securities, allowing you to participate in the world of stocks and other investments with ease.

The process of opening a Demat account is surprisingly easy. Here's a comprehensive step-by-step guide to help you understand this essential procedure:

- Explore different Demat account providers and compare their fees, features, and customer service offerings.

- Opt for a provider that best meets your requirements.

- Gather the necessary information, such as your PAN card, Aadhaar card, and bank statements.

- Fill out the Demat account opening form online. Double-check all information for accuracy before submitting it.

- Wait for a confirmation from the service provider. They may require additional documents or verification.

- Complete the KYC (Know Your Customer) process by providing any missing documents and submitting them electronically.

- Once your Demat account is activated, you can start trading securities with confidence.

Dematerialization Accounts Demystified: A Newbie's Primer on Digital Investing

Embarking on your investment journey? Demat accounts are the gateway to this exciting world. Essentially, a Demat account is a digital repository where you store your securities electronically. Think of it as your online bank account for shares and other financial instruments.

Gone are the days of physical share certificates cluttering your drawers. With a Demat account, your investments are held in electronic form, streamlining the trading process.

- Benefits include faster settlements, reduced paperwork, and increased accessibility to your investments.

- To establish a Demat account, you'll need to choose a reputable Depository Participant (DP), such as a stockbroker or bank.

- Complete the application process and provide the essential documents for verification.

Once your account is activated, you can begin trading in the stock market with ease. Remember, a Demat account is your copyright to the world of online investing.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Barbi Benton Then & Now!

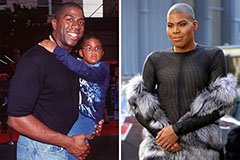

Barbi Benton Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!